Chennai, Dec 7: The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) on Wednesday in a 5:1 decision increased the repo rate by 35 basis points (bps) to 6.25 per cent to contain inflation.

The repo rate, also called the policy rate, is the interest at which RBI lends money to commercial banks.

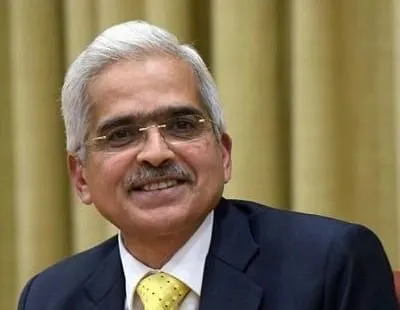

RBI Governor Shaktikanta Das, heading the MPC, announced the rate hike and added that the battle against inflation was not over.

With this, the MPC has increased the repo rate by 225 points this fiscal.

“Consequently, the standing deposit facility (SDF) rate stands adjusted to 6 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.50 per cent,” Das said.

The MPC also decided by a majority of 4 out of 6 members to remain focused on the withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth.

Considering the falling commodity prices in the global markets, uncertainty as to geo-political hostilities, the outlook for the US dollar and imported inflation, resurgence in the domestic services sector and the crude oil price at $100/barrel, the RBI pegged the headline inflation at 6.7 per cent in 2022-23, with Q3 at 6.6 per cent and Q4 at 5.9 per cent.

The Consumer Price Index (CPI) inflation for Q1FY24 is projected at 5 per cent and for Q2 at 5.4 per cent, on the assumption of a normal monsoon, Das said.

The MPC also pegged the gross domestic product (GDP) growth for this fiscal at 6.8 per cent with Q3 at 4.4 per cent and Q4 at 4.2 per cent.

The real GDP growth is projected at 7.1 per cent for Q1FY24 and at 5.9 per cent for Q2.

“Even after this revision in our growth projection for 2022-23, Ind ia will still be among the fastest-growing major economies in the world,” Das said.

When queried about the difference in GDP growth projections between RBI and the World Bank Das said the difference is very marginal and we do not have the data on which the World Bank had based its projection.

Das said the current account deficit (CAD) is manageable.

Terming the Indian economy resilient and the inflation moderate Das said the battle against inflation will continue, keeping the economic growth aspect in sight.