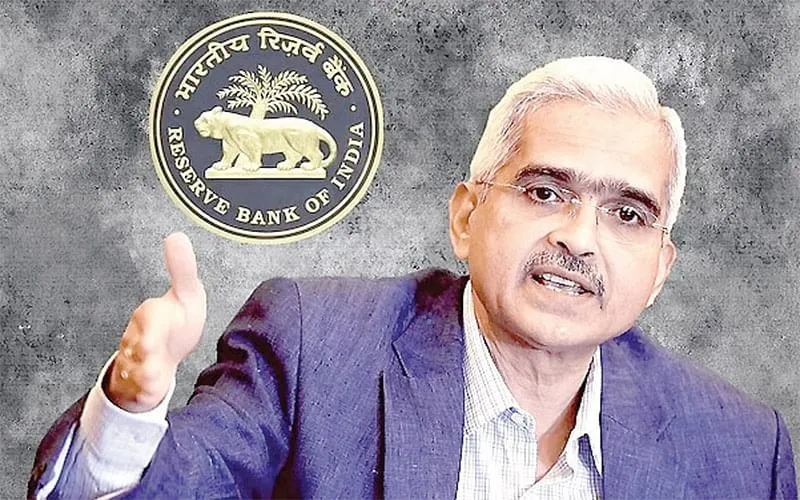

Following are the highlights of the RBI monetary policy announced by RBI Governor Shaktikanta Das on Friday:

► Interest rates left unchanged for 4th time in a row;

► Short-term lending rate (repo) stands at 4 pc;

► RBI decides to continue with accommodative stance as long as necessary;

► RBI Guv says Indian economy is poised to move in only one direction and that is upwards;

► RBI projects GDP growth at 10.5 pc for 2021-22;

► RBI revises retail inflation outlook; 5.2 pc for Q4:2020-21, 5 pc in H1:2021-22 & 4.3 pc for Q3:2021-22;

► Guv Das says Union Budget has provided strong impetus for revival of sectors like health, infrastructure;

► RBI to restore CRR to 4 pc in two phases beginning March 2021;

► RBI proposes to provide funds from banks under TLTRO on Tap scheme to NBFCs for incremental lending;

► RBI announces new scheme to incentivise new credit flow to MSME;

► RBI to set up panel to provide a medium term road map for strengthening of Primary (Urban) Co-operative Banks;

► Retail investors to get direct access to government securities market; with this India will join select countries providing such facility;

► Round-the-clock helpline for digital payment services to be set-up for grievance redressal;

► RBI will integrate all Ombudsman schemes & introduce centralised processing of grievances;

► Next meeting of the RBI Guv headed rate-setting panel MPC to take place during April 5 to 7.