Over Rs 477 crore, of a `945 crore corpus fund, has been approved to incubators under Startup India Seed Fund Scheme (SISFS) as on 31 December 2022, Minister of State for Commerce and Industry Som Parkash said on Friday.

In a written reply to a question in Rajya Sabha, the minister said, “Under the Scheme, Rs. 477.25 crore has been approved to 133 incubators of which Rs. 211.63 crore has been disbursed as on 31st December 2022.”

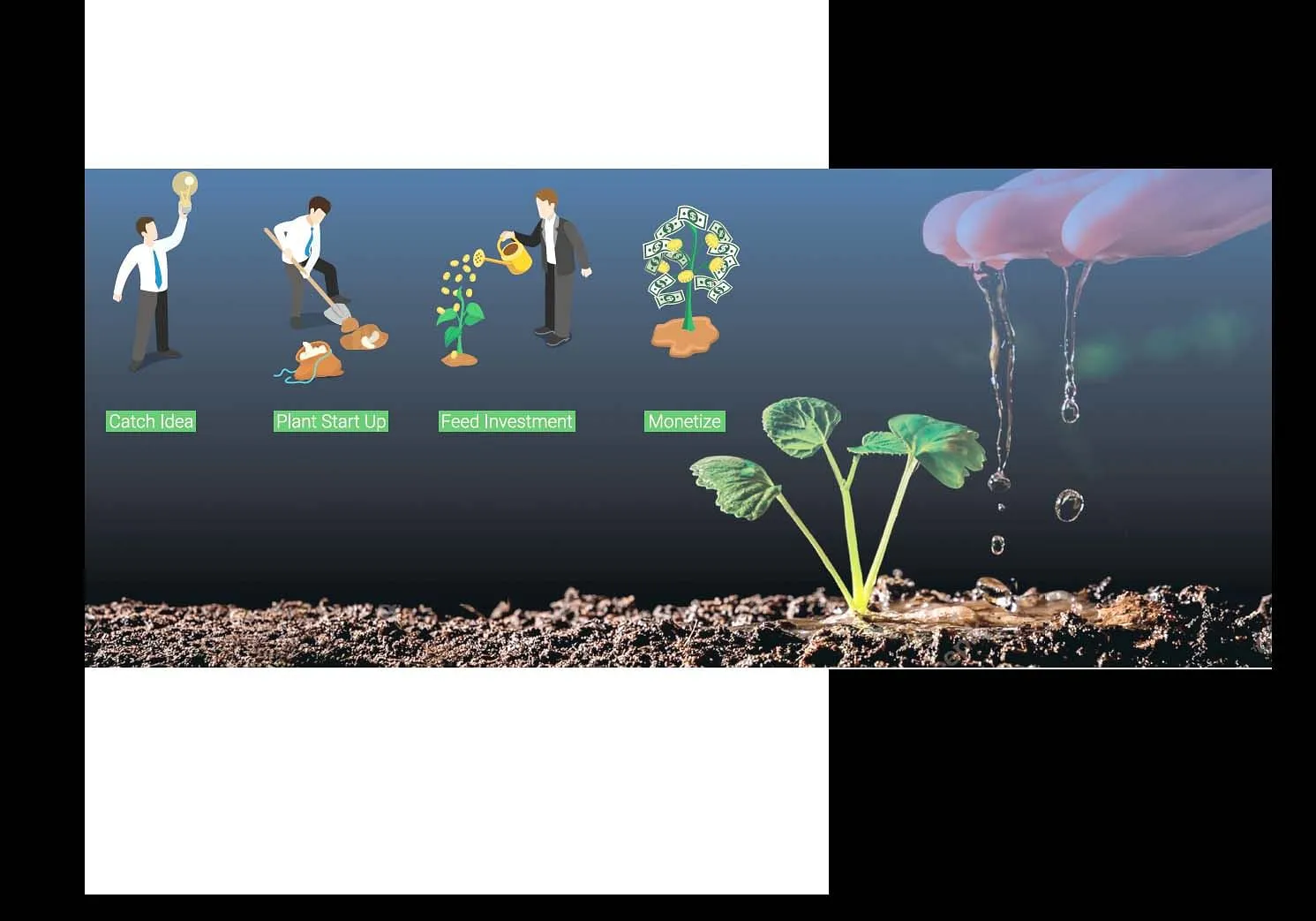

Fagship schemes under Startup India–Fund of Funds for Startups (FFS), Startup India Seed Fund Scheme (SISFS) and Credit Guarantee Scheme for Startups (CGSS)–extend support to startups at various stages of their business cycle. The startups thereafter, are able to raise investments from angel investors or venture capitalists or seek loans from commercial banks or financial institutions.

The Startup India Seed Fund Scheme (SISFS), which is being implemented by the government with effect from 1 April 2021, provides financial assistance to eligible Department for Promotion of Industry and Internal Trade (DPIIT) recognised startups for proof of concept, prototype development, product trials, market entry and commercialisation. This enables the startups to graduate to a level where they will be able to raise investments from angel investors or venture capitalists, or seek loans from commercial banks or financial institutions. The Centre also conducts annual exercises and programmes including States’ Startup Ranking, National Startup Awards and Innovation Week which play an important role in holistic development of the startup ecosystem.

“The government through stakeholder consultations seeks regulatory and policy related recommendations for enhancing ease of doing business and reducing compliance burden for startup ecosystem. It also facilitates participation and engagement of Indian startup ecosystem at international platforms,” the Ministry of Commerce & Industry said.

How angel tax continues to fail startup India

99% of India’s startups have not received any of the govt’s income tax benefits

Angel tax epitomizes how unintended consequences can undo the best of intentions. Section 56(2)(viib) of the tax code taxes the difference between the issue price of unlisted securities and its fair market value (FMV), which needs to be determined by a merchant banker either using book value or discounted cash flow method. Introduced in 2012 as a “measure to prevent generation and circulation of unaccounted money”, it arose due to a prominent political leader’s company receiving unaccounted share premium of `277 crore.

Since 2016, this section has been aggressively misapplied to Indian startup’s raising funds from investors. It was called angel tax as it applied primarily to Indian angel investors—HNIs and family offices who invested in startups. Despite the name, it was applied on startups and not the investor. The impact was restricted primarily to early-stage startups as most of the capital in later stages comes from foreign funds. An analysis of the largest funding rounds of 2021 and 2022 puts investments by Indian funds in the low single digits in terms of capital.

Sebi-registered alternative investment funds and non-residents were exempt. Budget 2023 expanded it to include foreign investors, despite many such investors being registered and regulated by their securities regulators. Yet their investments would expose the startup to angel tax. Extending the scope of this to non-residents is not the parity sought by the industry.The misapplication of angel tax on Indian startups was diabolical. Tax officials questioned valuations by comparing them to actual performance. Deviations were taken as a sign of money laundering, thus attracting the section. Investors wouldn’t invest further as any capital would be used to clear the angel tax liability. Numerous startups have shut down due to this, with entrepreneurs choosing to set up in Singapore or the US instead of India. India has lost job creators due to this section.

A startup in India has two definitions—one by the income tax department and one by DPIIT. The DPIIT definition of a startup is a company or firm with revenues of less than `100crore, a tenure of less than 10 years and one that is not a subsidiary or spin-off of another entity. DPIIT has registered over 84,000 startups through this simple, objective definition.

To avail income tax benefits, a DPIIT startup meets criteria stated in Section 80IAC, i.e., incorporation between 1April 2016 and 1 April 2024, and deemed “innovative” by the Inter-Ministerial Board (IMB)—a group of bureaucrats. Less than 1% of India’s 84,000 startups are IMB-certified. 99% of India’s startups have not received the government’s income tax benefits, including tax holidays, carry forward of accumulated losses due to shareholding changes, exemption from angel tax and deferment of Esop tax for employees.

These tax benefits exist only on paper and have no impact on startups. Reform of this IMB framework was highlighted in the 2023 Economic Survey to prevent startups from flipping overseas. Instead of IMB, all AIF-funded startups should qualify for tax benefits. Safeguards like minimum investment, and dematerialization of securities can be used to prevent abuse.

The fevered pitch on angel tax, along with the failure of IMB framework, prompted the introduction of a new measure called “Form 2” to exempt DPIIT startups from angel tax. This is an unfortunate case of the cure being as bad as the disease. Form 2 gives exemption for seven years, provided a startup doesn’t make loans or advances, invest in shares or make capital contributions. Therefore, benign activity like a salary advance, vendor advance, rental deposit, Esop trust, stock M&A, creating a subsidiary violate Form 2. This is pushing startups to move overseas.

Considering the host of anti-abuse measures introduced since 2012 such as disclosure of all unlisted investments in tax returns, mandatory disclosure of PANs, reporting all securities transactions to the tax department, why does angel tax need to exist? Listed firms are exempt due to dematerialization, which startups will gladly do and undertake as they scale. The ecosystem is willing to combat this menace of illicit funds, but it’s sick of being the collateral damage to ill-conceived regulations being misapplied to them.

Startup working to bring MSMEs into metaverse secures funds on Shark Tank India

Cloudworx, an Indian AI startup that helps build 3D models requiring no former knowledge of coding received `40 lakhs investment on Shark Tank India season 2. Their innovation has already received a patent in 2019.

Coding is essentially the ability of writing computer programs using a defined language. The startup Cloudworx claims it has found a way where a user doesn’t need to learn coding language to make a 3D model work. From a survey conducted by Gartner, 75% of businesses want to implement digital twins (3D models), but only 13% have implemented it so far; the other 62% have it on their roadmap but find it hard or don’t have the direct skill set in the team to implement it, Cloudworx stated.

“Without going to your own factory, you can monitor which machine of your factory is utilising more energy. This is through a technology called heat mapping, i.e monitoring the temperature of the object. Even employees can be monitored through their body temperature stamps and the boss can know which area has the most amount of employees huddled together,” said Yuvraj Tomar, Cloudworx founder, who also featured in inaugural Forbes Asia 30 under 30 list in 2016. There is no need for a web browser as any employee can scan a code and access the digital 3D model of the company store,” Tomar added.

The founder claimed on Shark Tank India that the app offers major steps- First, it connects devices, network, software, people and processes. Second, imports 3D models and lets clients customise the feel and look of their virtual store. And third, build 3D workflows without writing any code.

Founded in 2020, the company aims to make metaverse accessible and easy to use and understand. The company claimed to have made `1.5 crore annual sales since 2020. They also reported no profit on the show. On why the company’s sales were low, Cloudworx founder said, “Sales were low because we made the mistake of only concentrating on the India market initially where usage is still picking up. When we expanded to other countries, we started gaining clients. European clients are especially easily convertible,” Tomar claimed.

Shark Namita finds a use case for the service

Shark Namita Thapar, who manages 14 factories of Emcure Pharmaceuticals was interested in the startup as the founder displayed how she can use it for her benefit via a demo.

“You manage 14 factories and often would need to be physically present for monitoring their output. With the use of this technology, you won’t need to be dependent on charts, dashboards, graphs to make decisions. You can monitor your factories from anywhere. One click from the software can physically switch on or shut down any functions in the factory,” he claimed.

On Thapar’s call of ‘shaking the world of MSMEs’, the final deal was sealed with the Emcure executive director and Anupam Mittal at `40 lakhs with 3.2% equity at valuation of `12.18 crore . The startup had already raised `71 lakhs in a seed round that happened in May 2020 at valuation of `8 crore.

Rest of the sharks opt out

Anupam Mittal, co-founder of Shaadi.com wished to know how the founder will compete with the big tech giants of the world and build a global presence.

“I am not targeting the Fortune 500 companies who will only approach global tech giants for their work. My clients will be the SMEs and MSMEs who can’t afford the fees of tech giants like Microsoft and gaming giant Nvidia. One Microsoft and Nvidia license will cost $1 to $2 million. If someone in the field is providing the same features at one hundredth the cost, why would any client not want to jump in?”, Tomar said.

Amit Jain, co-founder of CarDekho, stepped out of the deal claiming the platform offers no innovation and the products that they offer are already available in the market. CEO and co-founder of Sugar Cosmetics Vineeta Singh stepped out of the deal as well.

“Your platform needs two things to succeed. One, it needs to build an international B2B market and second, you need to be constantly updated with the innovations that are happening in this field. I won’t be of much help there,” Singh said.

Suggesting he should concentrate more on the vast opportunities of consumer metaverse, co-founder of boAt Aman Gupta denied funding to the startup.