Seeking to curb excessive salary payout practices, theReserve Bank has proposed strict compensation norms for senior officials ofprivate as well as foreign banks, including minimum 50 per cent variablecomponent and money clawback provisions.

Floating a discussion paper, the central bank has alsoproposed that variable pay of CEO and whole-time directors, among other keypersonnel, should be “capped at 200 per cent of fixed pay”. Earliervariable pay was capped at 70 per cent of fixed pay but did not includeEmployee Stock Option Plan (ESOP).

High pay packets and excessive risk-taking ways in thebanking industry have been under the scanner ever since the global financialcrisis of 2008. Employees were too often rewarded for increasing short-termprofit without adequate recognition of the risks and long-term consequences fortheir organisations.

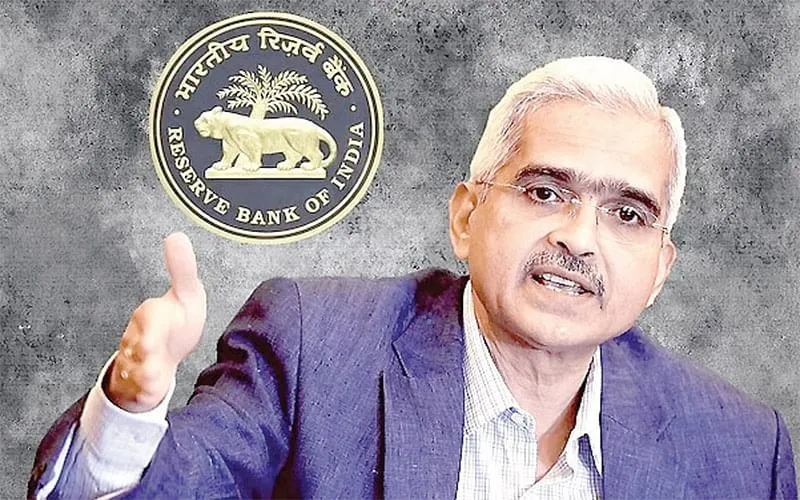

The latest discussion paper proposing changes tocompensation norms comes more than seven years after the Reserve Bank of India(RBI) issued such guidelines for private and foreign banks.

“These (2012) guidelines are being reviewed, with anobjective to better align with FSB (Financial Stability Board) Principles andImplementation Standards, based on experience and evolving international bestpractices,” the RBI said.