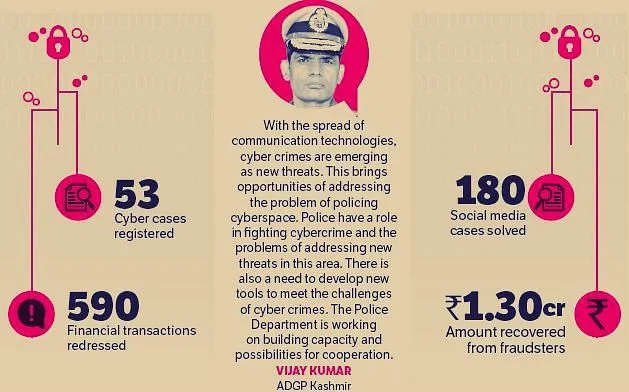

Srinagar: During the current year Cyber Police Kashmir has registered 53 cases, redressed 590 financial transactions, and solved about 180 social media cases.

Senior officials of Cyber Police Kashmir told Greater Kashmir that an amount of over Rs 1.30 crore was saved from the fraudsters.

Talking to Greater Kashmir, Additional Director General of Police (ADGP), Kashmir, Vijay Kumar said, “With the spread of communication technologies, cyber crimes are emerging as new threats. This brings opportunities of addressing the problem of policing cyberspace. Police have a role in fighting cybercrime and the problems of addressing new threats in this area. There is also a need to develop new tools to meet the challenges of cyber crimes. The Police Department is working on building capacity and possibilities for cooperation.”

Mostly, gullible people fall prey to cyber fraudsters.

“People are coming forward once they face problems related to cyber,” the Cyber Police officials said.

They said that Cyber Police Kashmir was trying to redress their problems at the earliest.

“In case of money extortion by fraudulent means, we try to block the accounts and save money if it is reported in time,” the officials said.

The officials of Cyber Police, Kashmir said that there were numerous cybercrimes that they were dealing with including fake WhatsApp Dp scams, online job fraud, Vishing, impersonation through social media platforms, scams through social media marketplaces, online sextortion, and KYC scams.

FAKE WHATSAPP DP SCAM

WhatsApp fraud is a form of fraud in which cybercriminals pretend to be a victim’s acquaintance and ask them for money.

Currently, most of those criminals pose as a friend or family member and ask for financial help because “they urgently have to pay a (high) bill” or “they have an emergency and urgently need some money”.

ONLINE JOB FRAUD

Online job fraud is an attempt to defraud people who need employment by giving them false hope or promise of better employment with higher wages.

VISHING

Vishing is an attempt where fraudsters try to seek personal information like customer ID, net banking password, ATM PIN, OTP, card expiry date, and CVV through a phone call.

IMPERSONATION THROUGH SOCIAL MEDIA PLATFORMS

Impersonation and identity theft is an act of fraudulently or dishonestly making use of the electronic signature, password, or any other unique identification feature of any other person.

SCAM THROUGH SOCIAL MEDIA MARKETPLACES

Social media sites offer some scammers a platform for phishing. Phishing scams involve tricking you into sharing sensitive personal information that is exploited later on. Buyers or sellers may unknowingly hand their information over to scammers.

Investment fraud happens when people try to trick one into investing money. They might want people to invest money in stocks, bonds, notes, commodities, currency, or even real estate.

A scammer may lie to one or give fake information about a real investment or they may make up a fake investment opportunity.

Loan offer fraud is the scamming of people looking for loans, giving them false hope of providing a huge amount of hassle-free loans at lower interest rates most often luring the victim to install a third-party app for the scam.

ONLINE SEXTORTION

Online Sextortion occurs when someone threatens to distribute private and sensitive material using an electronic medium if he or she does not provide images of a sexual nature, sexual favours, or money.

KYC SCAM

This scam is commonly known as a Remote Access Mobile Application Scam. In this type of scam, the scammers sent fake messages to different customers of different mobile companies like BSNL and Jio for completing KYC of the mobile connection and giving a warning message that their SIM would get deactivated and share a cell number to call as Customer Care number. Most of the BSNL and Jio customers are getting these fake SMS messages which instruct customers to share their KYC details by calling a mobile number.

On dialing the number, the fraudsters introduce themselves as BSNL Customer Care Executives and ask to complete the KYC verification by downloading an app (BSNL Quick Support), AnyDesk, QR Viewer, TeamViewer from Google Play Store or directly sending the links to download these remote access apps.

Unaware of this, the victim downloads the apps and allows the fraudster to see everything on their phone. The fraudster then asks the victim to log in to the banking application app and then login out again — this lets them see not only the victim’s login user ID but also their password.

Once the login process is complete, the scammer asks the victim to transfer an amount of as little as Re 10 to validate whether the KYC process has been completed.

With this, the scammer can see the Banking MPIN for the account and then proceeds to siphon off thousands and lakhs of rupees from the customer’s account within a few minutes in multiple transactions.